The Strategist’s Secret Weapon for Exponential Growth

The Chessboard of Strategy

In the 1980s, IBM dominated mainframe computers while Microsoft focused on the embryonic PC market—a classic long-term gamble. Bill Gates famously said, “We always overestimate the change that will occur in two years and underestimate the change that will occur in ten.” This encapsulates the power of long-term thinking: the deliberate prioritization of future exponential gains over immediate rewards.

This isn’t just philosophy—it’s mathematics. Research from McKinsey reveals companies focused on long-term strategies generate 47% higher revenue growth and 36% higher earnings than short-term peers over 15 years. Yet, 87% of executives admit to prioritizing quarterly earnings over long-term value (Harvard Business Review).

Why Short-Term Thinking Fails: The Plateau Effect

Short-term tactics deliver visible results quickly but inevitably plateau. Consider:

Marketing: Viral TikTok campaigns spike traffic but rarely build brand loyalty.

Product Development: Rushed features address immediate bugs but create technical debt.

Finance: Cost-cutting boosts quarterly profits but starves R&D.

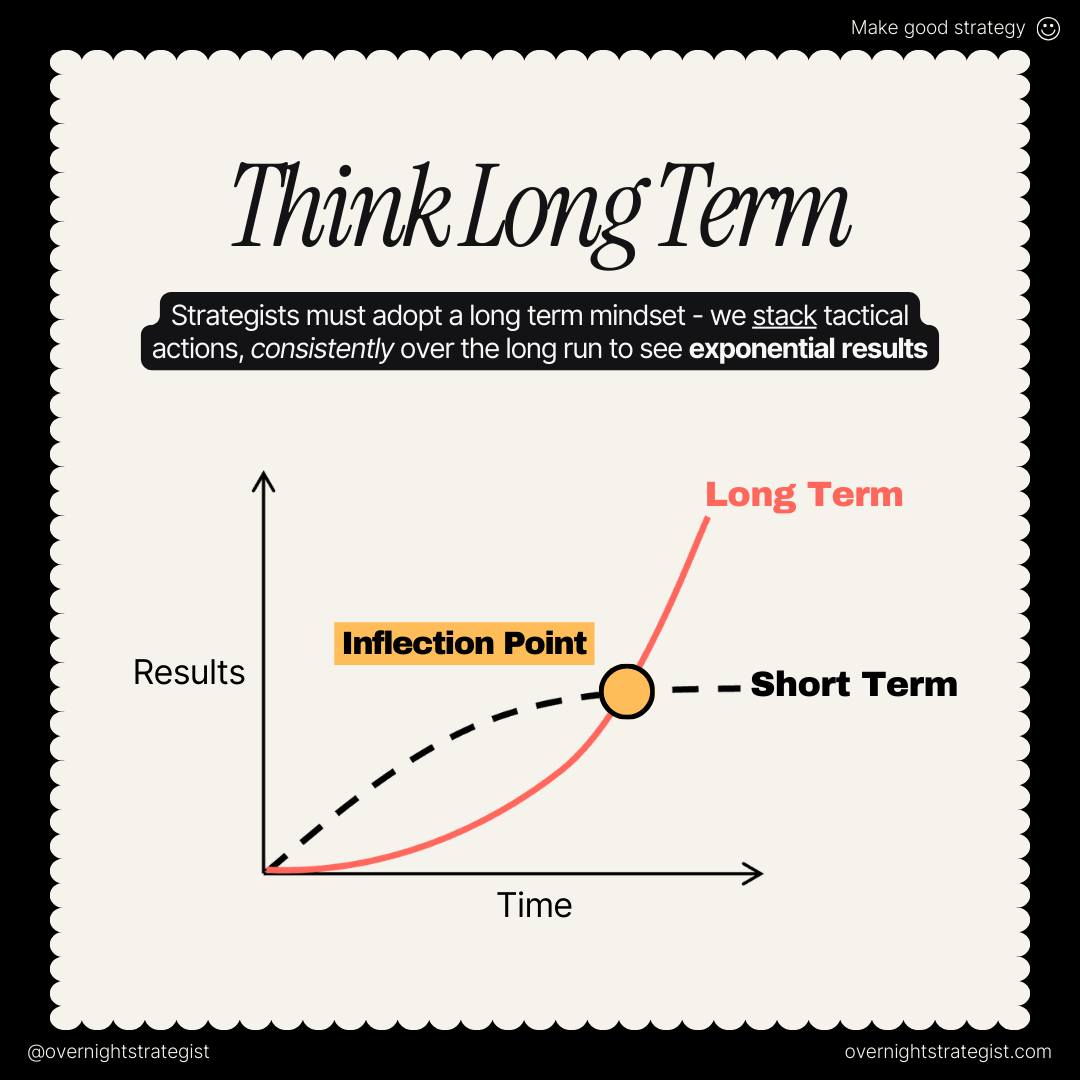

The graph in Juan Fernando Pacheco’s image reveals the inflection point—where compounding long-term efforts overtake linear short-term gains.

The Four Pillars of Long-Term Strategy

1. Sustainable Growth: Building Foundations

Short-term wins = fireworks (bright, brief). Long-term strategy = architecture (enduring, scalable).

Tools & Frameworks:

Flywheel Model (Amazon): Inputs (customer experience) → Outputs (traffic/sellers) → Reinvestment. AWS began as internal infrastructure; now dominates cloud computing with $90B revenue.

Input: Customer obsession metrics

Output: Compound annual growth rate (CAGR)

Reference: Amazon’s 1997 Letter

2. Resilience: Antifragile Systems

Long-term thinkers design systems that gain from volatility. Example: Netflix’s 2007 pivot from DVDs to streaming amid Blockbuster’s short-term rental focus.

Best Practices:

Scenario Planning: Shell’s 1970s oil crisis simulations enabled 50-year resilience.

Tool: Monte Carlo simulations (Python/Pandas)

Input: Risk probability matrices

Output: Contingency playbooks

Reference: Shell Scenarios

3. Innovation: Patient Cultivation

Breakthrough innovation requires temporal slack—Google’s “20% time” birthed Gmail and AdSense.

Frameworks:

Horizon Model (McKinsey):

Horizon 1 (0-2 yrs): Core optimizations

Horizon 2 (2-5 yrs): Emerging opportunities

Horizon 3 (5+ yrs): Disruptive R&D

Tool: Innovation Accounting (Track leading indicators like experiments run, not just ROI)

Reference: The Three Horizons of Growth

4. Deep Impact: Legacy Systems

Patagonia’s “1% for the Planet” (1985) seemed costly—now drives $1B sales from eco-conscious millennials.

Tool: Legacy Mapping

Input: Core values → 10-year vision → Keystone projects Output: Impact valuation (e.g., B-Corp certification) Framework: Theory of Change models

The Inflection Point: Where Compounding Takes Flight

The “overnight success” fallacy obscures the grind before the inflection point:

Tesla: 15 years of losses before 2020’s $1T valuation

Compound Interest: $10k at 10% for 20 yrs = $67k; 30 yrs = $174k

Tech Debt: Short-term coding saves 100 hours now but costs 1,000+ hours later

Mathematical Proof:

Long-term outcomes follow exponential curves:

y = a(1 + r)^t

Where:

a= Initial investmentr= Consistent effort ratet= Time

Short-term efforts plateau as logarithmic functions.

Implementation Toolkit: Architecting Long-Term Advantage

1. Strategic Alignment Frameworks

OKRs (Objectives & Key Results)

Input: 10-year vision → 3-year objectives → Annual KR

Tool: Weekdone, Gtmhub

Output: Alignment scorecards

Case Study: Intel’s escape from memory chips (1970s)

Wardley Mapping

Visualize capability evolution (Genesis → Commodity)

Input: Value chain analysis

Output: Strategic timing decisions

Reference: Wardley Maps Book

2. Cultural Enablers

Delayed Gratification Metrics:

Track learning velocity over sprint completion

Reward systems for long-term bets (e.g., Promotions for 5-year projects)

Psychological Safety: Google’s Project Aristotle shows teams with safety innovate 300% more

3. Technology Infrastructure

Data Lakes over Dashboards:

Store raw data for future AI/ML use (e.g., Snowflake)

Avoid “dashboard myopia” – prioritize 5-year data retention

Composable Architecture: MACH principles (Microservices, API-first, Cloud-native, Headless) enable future adaptability

4. Personal Long-Term Systems

Deep Work Blocks: 4 hrs/week of no-meeting strategy time

5/25 Rule (Warren Buffett): Focus on 5 critical goals, ignore 20 distractions

Tool: Notion for life roadmaps

Case Study: Microsoft’s 10-Year Cloud Bet

2008-2010 (Investment Phase)

Inputs: $20B+ CAPEX, cultural shift to “cloud-first”

Pain: Stock dipped 45% as Azure lost money

2018-2023 (Inflection Point)

Outputs: Azure dominates with 34% market share

Compounding: Enterprise lock-in via Azure → Teams → Power Platform

Overcoming Short-Term Traps

Quarterly Earnings Prison:

Countermeasure: Shift investor communication to long-term KPIs (e.g., Tesla’s “master plan” decks)

Feature Factory Syndrome:

Solution: Horizon budgeting (70/20/10 rule: 70% Horizon 1, 20% H2, 10% H3)

Discount Rate Bias:

Tool: Net Present Value++ (NPW) calculations weighing strategic optionality

Your Long-Term Playbook

Conduct a Time Audit:

Calculate % effort on Horizon 2/3 vs. Horizon 1

Build Inflection Catalysts:

Automate compounding engines (e.g., referral programs, knowledge bases)

Adopt Slow Metrics:

Technical: Code maintainability index

Marketing: Customer lifetime value (LTV)

Product: Habit formation rate

Install Governance Rituals:

Quarterly strategy retreats

Annual “pre-mortems” (simulate 10-year failures)

The Exponential Mindset

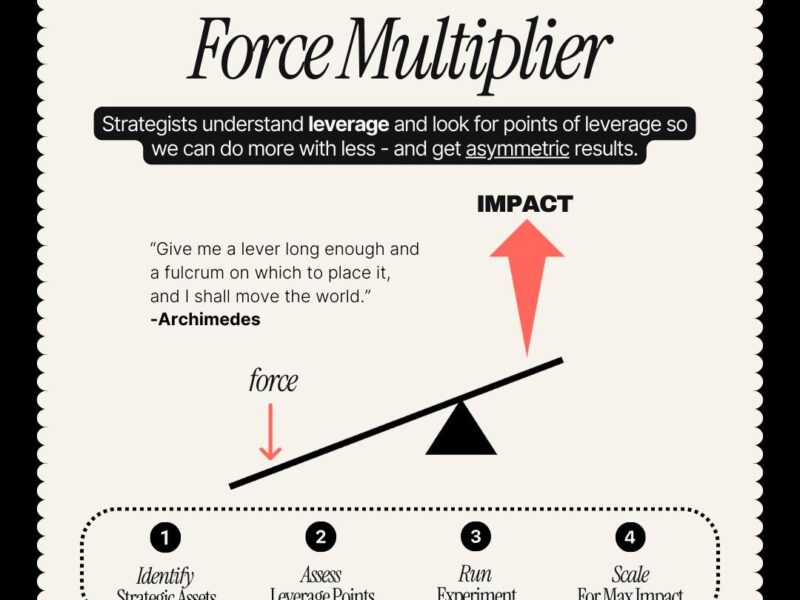

Long-term thinking isn’t neglect of the present—it’s leverage architecture. As Ray Dalio notes in Principles:

“Evolution is the greatest force in the universe… it compounds over time.”

The overnight strategist understands: True advantage comes when you plant trees knowing you’ll never sit in their shade. Your inflection point awaits.

Further Reading:

The Compounding Effect of Consistent Strategy (Harvard Business Review)

Image credits: OverNightStrategist